One of the most common mantras to long-term investors from stock market gurus is to let your winners ride (i.e. hold on to rising stocks for the long term, letting their gains build over time), but cut your losses quickly (sell stocks as soon as you have a 3%-8% loss in them). History shows that this simple system usually succeeds, even when it means selling 5-10 stocks at a loss for every one stock held onto for a long-term gain... and yet VERY few average investors are disciplined enough, or have the right temperament, to execute this approach.

This post from another blog (with reference to a more thorough study), points to individuals' illogical "loss aversion" as the culprit in their unsuccessful behavior. The fear of realized financial loss or failure (which is only 'on paper' or potential, until a stock is actually sold) is so great as to override their willingness to sell losing stocks that just might yet 'come back.' And contrarily, rising stocks are often sold too early, to 'lock in' profits, rather than letting them run to the greater heights they may be headed.

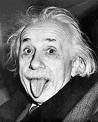

.... "If the brain was so simple that we could understand it, then we would be so simple that we couldn't." -- Emerson M. Pugh

''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment